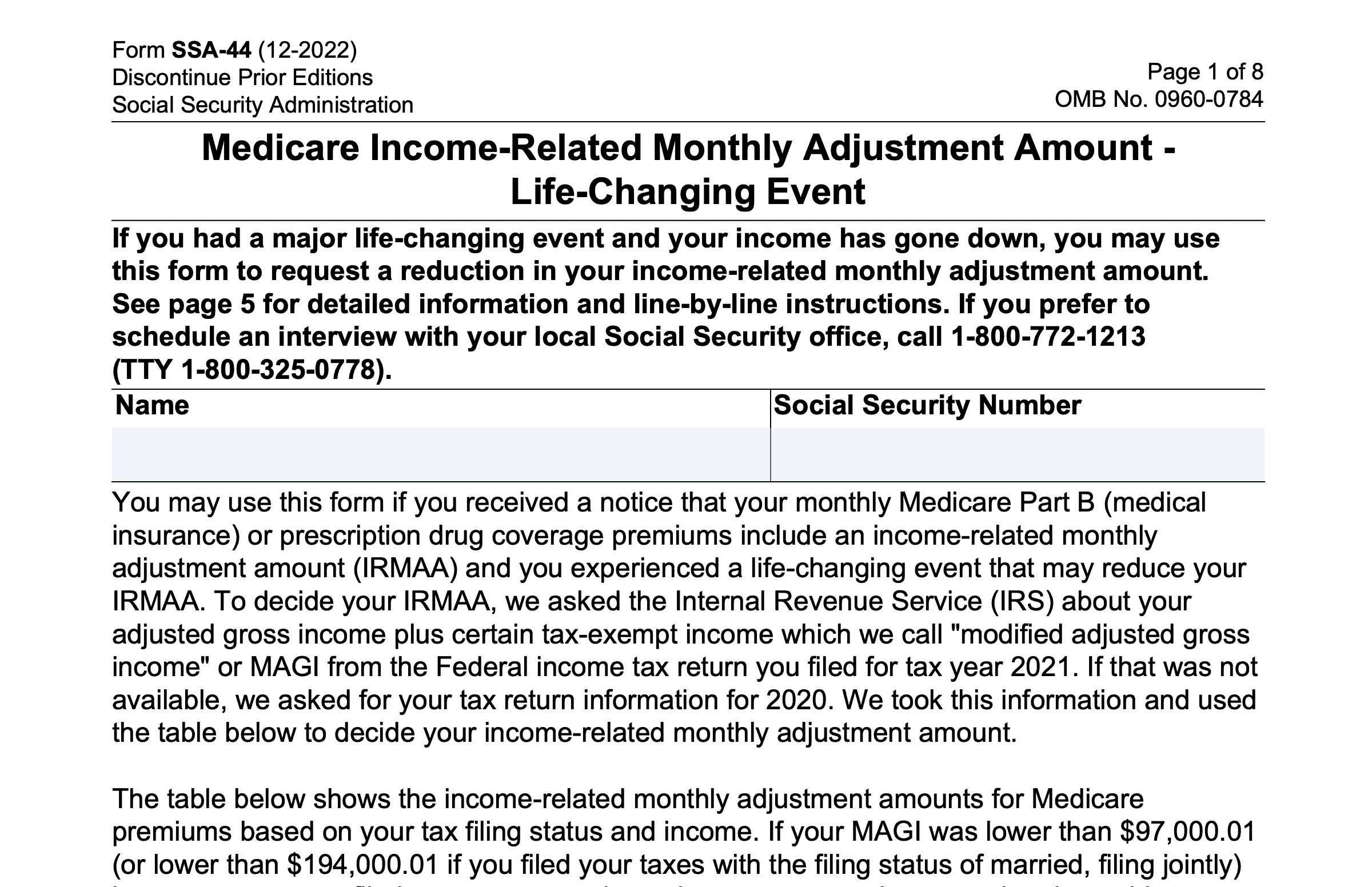

Irmaa Reimbursement Form 2025. Irmaa is a surcharge that people with income above a certain amount must pay in addition to their medicare part b and part d premiums. You can appeal these by completing the social security administration form ssa.

Irmaa is a surcharge that people with income above a certain amount must pay in addition to their medicare part b and part d premiums. You can appeal these by completing the social security administration form ssa.

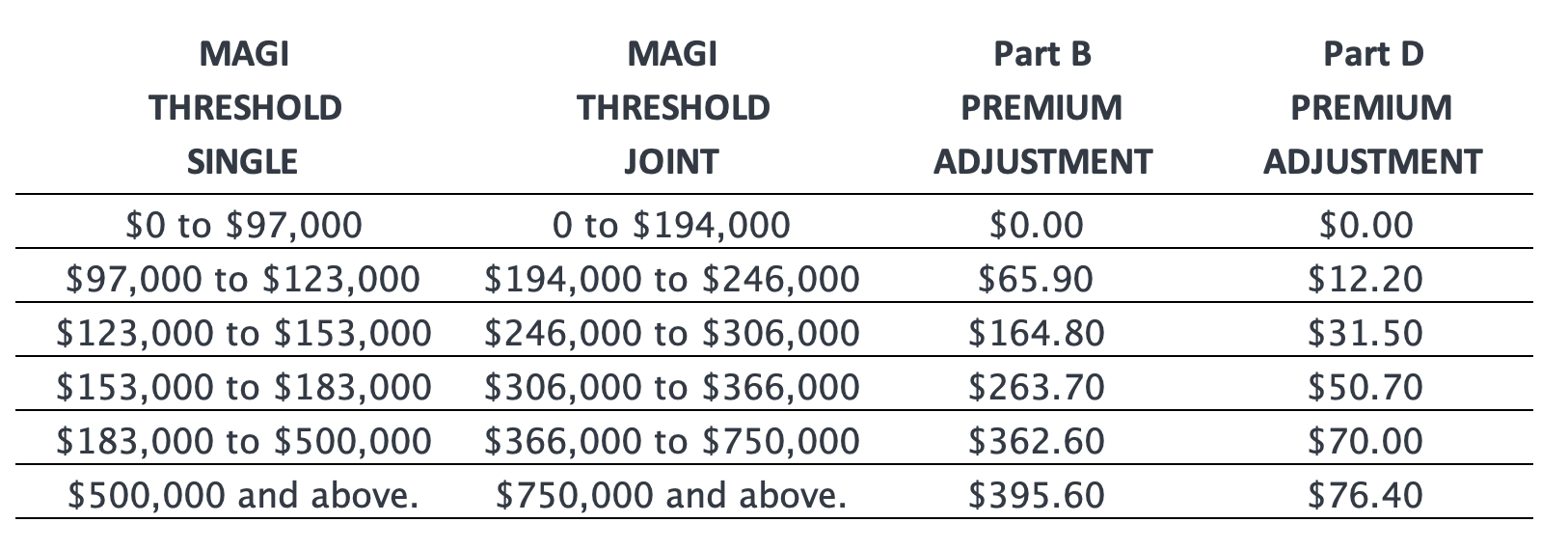

Irmaa Appeal Form 2025 Printable Forms Free Online, Irmaa applies in 2025 if your modified adjusted gross income from 2025 is above these thresholds:

Irmaa 2025 Form Printable Forms Free Online, Filing individually income > $106,000 married filing jointly income > $212,000

What Are the IRMAA 2025 Brackets (and How to Avoid It!), See the most current timeline and income thresholds for irmaa » members who paid the premium may qualify to be reimbursed from the city, but they must apply.

2025 IRMAA Brackets Based On 2025 2025 Whole Year Calendar, Filing individually income > $106,000 married filing jointly income > $212,000

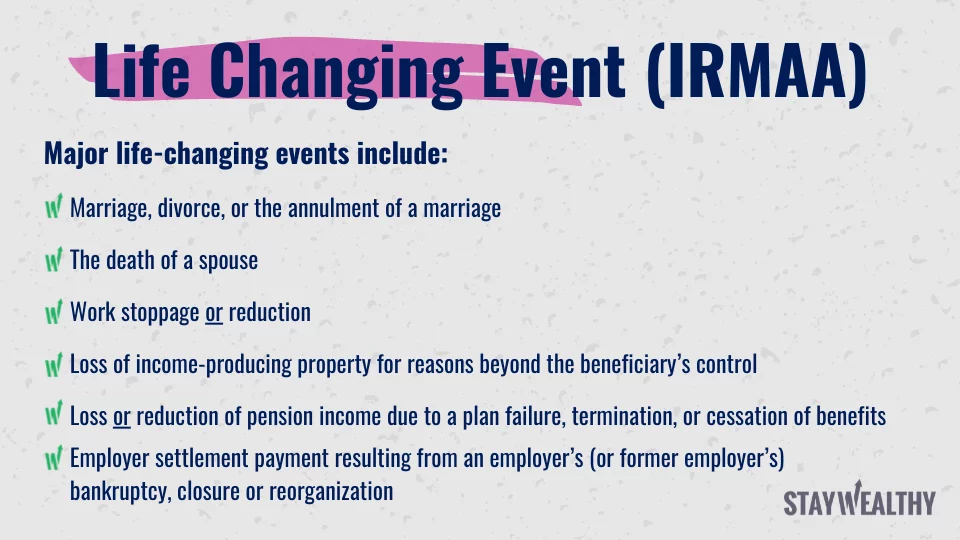

Fillable Online Your IRMAA Claim Form(s) Are Enclosed Fax Email Print, To calculate your irmaa, you will need to review your tax returns submitted to the irs two years prior to the current year.

2025 Irmaa Brackets Megan Butler, Irmaa 2025 annual reimbursements were issued during the 3rd week of october 2025.

Fillable Online irmaapartbandpartdclaimform.pdf NJ.gov Fax, An irmaa applies to beneficiaries who have an income level above a specific.

Irmaa Appeal 2025 Form Sean Morrison, Irmaa applies in 2025 if your modified adjusted gross income from 2025 is above these thresholds:

IRMAA 2025, 2025, And 2026 What You Need To Know Printable 2025, For 2025, beneficiaries whose 2025 income exceeded $106,000 (individual return) or $212,000 (joint return) pay a higher total medicare part b premium amount depending on.